No matter how hard we work in our 20s, we never seem to have enough money on our hands. That´s normally because we tend to make plenty of financial mistakes during these years. According to reliable sources, the average 25-year-old earns close to $39,300 annually. However, he also has an average debt of $45,300 to deal with. At this point in our lives, we also tend to pay little attention to our health. Statistics show that only 73% of 25-year-olds boast of having a health insurance. An even more frightening statistics state that only 67% people have enough emergency savings to last them for three months should they lose their jobs. So, how can you be in a better financial situation?

Well, for starters, you shouldn´t rush out of your parents´ house too early. Of course, who doesn´t enjoy independence and freedom? However, leaving your parents´ home too early isn´t the best move to make financially. Instead, you can choose to stay with your parents for a few more years, allowing you to save money which would have otherwise been used to pay rent and other things you take for granted at home. And, when you have enough saved up and are more financially prepared, you can then move out of your home.

Many young people also make the financial mistake of only making minimum payments on credit card bills. If you belong to that category of people, you need to stop doing that immediately. Technically, making a minimum payment on credit card bills means that you are not actually paying off your debt; you are only paying the interest on the debt. Of course, it feels great to have more money in your wallet, but it is even wiser to try to pay off credit card debt quickly.

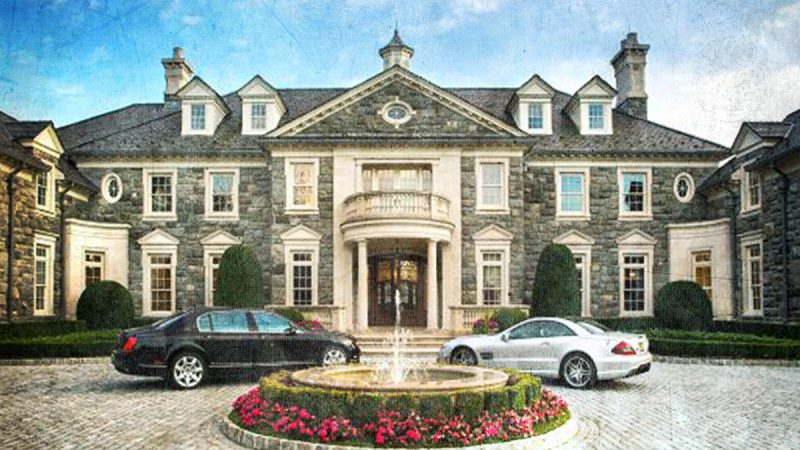

Many young people are more interested in showing their social status than ever in the contemporary world. Hence, these people find the need to spend on materialistic goods, products, and services. Therefore, instead of spending on needs, young people are more focused towards spending on wants—for instance, a new video game, a new makeup kit, a new car, expensive night outs etc. Spending sensibly will make you feel a lot better about yourself in the long run.

Another huge financial mistake people in their 20s often make is choosing to compromise on quality to acquire cheap products and services. This is a false economy as it can end up costing you more. After all, what´s the point of buying a cheap washing machine only to see it stop functioning after a few weeks? And, the expensive repair bill that comes afterwards—wouldn´t it be better to splurge on a quality product instead?